Hi!

I'm Mike Vestil

I became a self-made millionaire in 18 months and have learnt how to build passive income streams that allow me to live the life of my dreams. Want to learn more? Keep reading.

MY STORY

Mike Vestil | Passive Income Madscientist

My family is originally from the Philippines, where they flew to a small suburbs in the Midwest to try and live “The American Dream”.

Growing up, I wasn’t the smartest person in the world, and had no confidence in myself what so ever.

And because my parents were super Asian, they told me that I had to follow the “American Dream” too and that I had to be a nurse, doctor, dentist, or a family disappointment.. So I pursued the path of Dentistry.

And I absolutely hated it. So I did everything in my power to reach out to mentors who were a lot smarter than me, and who can teach me ways to gain freedom for my self that did not require a 9-5 job. This was one of those interviews.

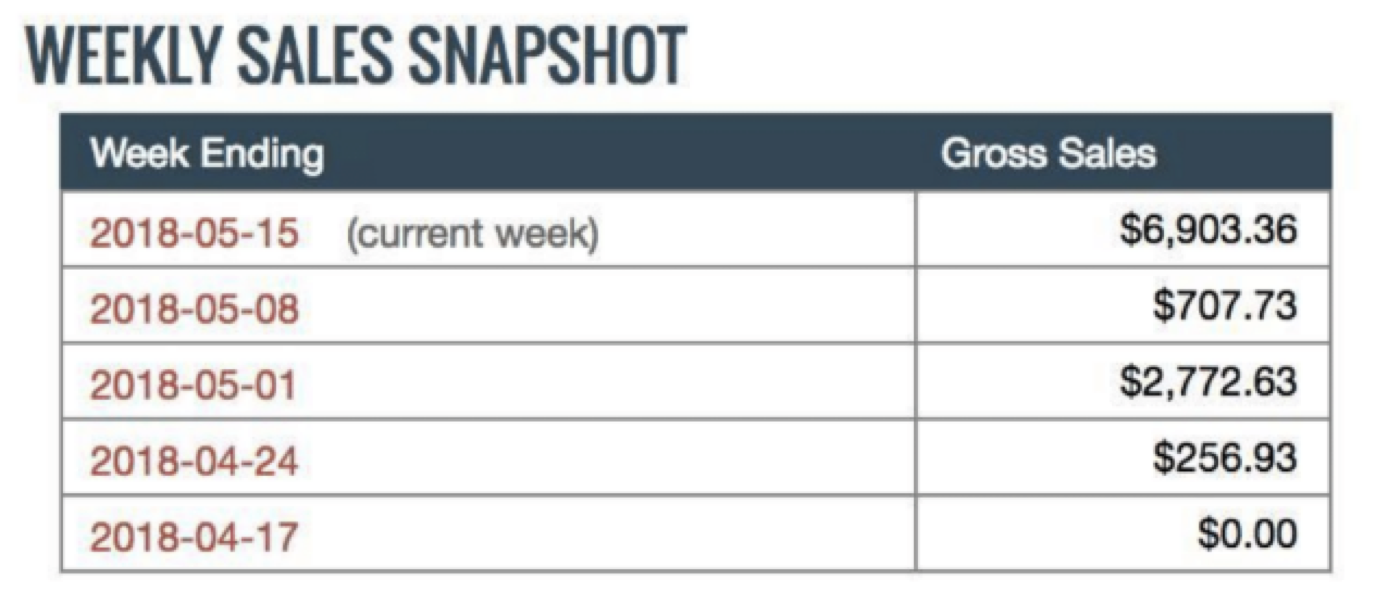

He explained to me how he used the concept of “leverage” to build online businesses without actually having to create a product or doing any of the order fulfillment. So I ended up trying it, and it worked. Here’s one of my first successful months.

But here’s the thing. This would have never happened if I did not find my why, if I did not find the right mentor, nor did I have the right system. Once I had all 3 was when I really started experiencing some crazy results and my life forever changed. Here’s what I did with the new found time freedom, money freedom, and location freedom.

I’ve traveled and lived in over 25+ different countries.

I spend a lot of my time now pursuing my passions.

And I even ended up writing a book.

And began teaching people exactly what my mentor taught me.

Want to know what the best online opportunity of 2024 based around your personality? Get started here