Carbon credits are a unit of measurement used to account for greenhouse gas emissions. One carbon credit is equal to one metric tonne of CO₂ equivalent. Carbon credits can be traded in national and international carbon markets. The biggest market is the European Union Emissions Trading System, but there are also many other regional and bilateral markets.

Investing in carbon credits can offset your greenhouse gas emissions or finance projects that reduce emissions in developing countries. By buying carbon credits, you are helping to create a market incentive for reducing emissions.

In this article, I will discuss what carbon credits are, and how you, as an investor, can earn from this relatively new opportunity.

What Are Carbon Credits?

Let's start with a carbon credit definition, as this will help you understand how carbon credits work.

A carbon credit is a generic term for any tradable certificate or permits representing the right to emit one tonne of carbon dioxide or its equivalent in other greenhouse gasses.

The concept of carbon credits comes from the Kyoto Protocol, an international agreement to reduce greenhouse gas emissions. The protocol was first signed in 1997 and came into effect in 2005.

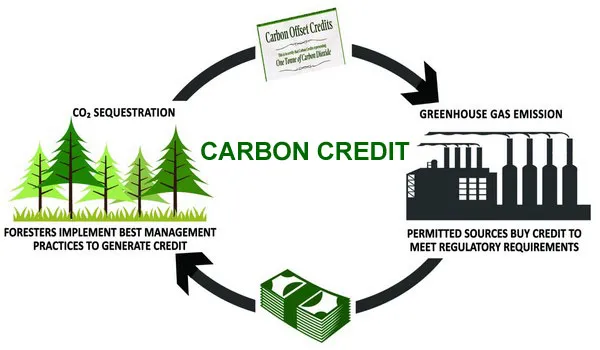

Image credit: https://medium.com/

Carbon credits companies take on projects that help to reduce greenhouse gas emissions. They then sell carbon credits to companies or individuals who want to offset their emissions.

A carbon credit exchange is a market where carbon credits are bought and sold. Prices for carbon credits vary depending on supply and demand.

While not considered as investing for beginners, traders interested in the environmental impact of their investment portfolio can speculate on the price of carbon credits without actually taking possession of any credits.

With such a huge demand to lower emissions and meet emissions targets, there is a lot of money to be made in carbon credits, and this could be a great way to retire early for those who know how to generate carbon credits.Carbon Credits Explained With An Example

The question "how do carbon credits work?", is better explained with an example.

Imagine you run a factory that emits 100 tonnes of greenhouse gasses into the atmosphere each year.

You could reduce your emissions by installing new, more efficient equipment. But this would be expensive, and it would take time to see any return on your investment. While this is the long-term plan to put into effect, there is a shorter-term action you can take.

This involves buying carbon credits to offset your emissions.

Suppose you buy carbon credits for $10 each. This would cost you $1,000, which isn't much considering your factory's outputs.

The money you spend on carbon credits would go to a carbon credits company. This company would use the money to finance projects that reduce greenhouse gas emissions, such as planting trees or installing solar panels.

The carbon credits company would sell you the carbon credits, which would offset your emissions. In other words, you would still emit 100 tonnes of greenhouse gasses, but the carbon credits would cancel out your emissions.

As such, with carbon credit companies, it's possible to offset your emissions without making any changes to your business.

Investing In Carbon Credits For Beginners: How Much Are Carbon Credits Worth?

When trading carbon credits, it's essential to be aware of the different carbon credits investments and their risks.

The main types of carbon credits are:

Here's what you need to know about them.

Avoidance Projects Carbon Credits

These carbon credits are about avoiding emitting GHGs altogether. This reduces the volume of GHGs emitted into the atmosphere, and as a result, these carbon credits are considered the most valuable.

For example, one of the best tips for traveling in this regard is to reduce your air miles. You can avoid emitting GHGs into the atmosphere by taking the train instead of flying. Therefore, companies promoting this type of culture change can generate carbon credits.Removal Carbon Credits

Removal carbon credits remove GHGs directly from the atmosphere. This can be done by planting trees or capturing methane gas from landfill sites.

Though still crucial, these carbon credits are generally less valuable than avoidance project carbon credits because they don't prevent emissions from happening in the first place.

What Is The Market Price For Carbon Credits?

The price of carbon credits depends on supply and demand.

If there's a high demand for carbon credits and a low supply, the price of carbon credits will be high. Companies are willing to pay more for carbon credits to offset their emissions.

Kyoto Protocol credits are the most common type of carbon credit. They can be traded on the European Union Emission Trading System (EU ETS) and other global exchanges.

How To Invest In Blue Carbon Credits

Blue carbon credits are those generated explicitly by the growth and preservation of carbon-absorbing plants, such as mangrove forests and their marine environment.

Investing in blue carbon credits is a way to help preserve these critical ecosystems while also earning a return on your investment.

Image credit: https://textilelearner.net/

Here are a few things to keep in mind if you're thinking about investing in blue carbon credits:

By following these tips, you can help reduce your risk and give yourself a better chance of earning a solid return on your investment.

How To Trade Carbon Credits: What You Need To Know Before You Invest In Carbon Credits

Using the right carbon credit trading platform is the first step to ensuring a successful carbon credit trading experience.

The platform must provide you with real-time data and analytics of the carbon credit market. It should also allow you to buy and sell credits quickly and easily.

Here are a few factors to consider when choosing a carbon credit trading platform:

How To Buy Carbon Credits Stock

The carbon credit market is global, and there are various ways to buy carbon credits.

When it comes to where to buy carbon credits, you can typically purchase them through a broker, an exchange, or directly from a project developer.

Each method has its advantages and disadvantages, so it's essential to compare the different options before you decide how to buy carbon credits.

However, one key fact in all situations is that buying or selling carbon offset credits should only be done through a reputable carbon offset provider, exchange, or broker.

How To Sell Carbon Credits

Any carbon credit project developer must know how to get paid for carbon credits.

When a developer creates a carbon offset project, they can choose to sell the credits generated by the project on the open market, or they can keep the credits and use them to offset their emissions.

There are a few different ways to sell carbon credits:

Understanding how to sell carbon credits is essential to running a carbon offset project. By selling your credits, you can generate additional revenue for your project and help offset the cost of running the project.

Considering that carbon tax credit is a new investment opportunity, it is essential to do your due diligence before investing. Work with a reputable carbon credit provider, exchange, or broker to ensure a successful transaction.

How To Invest In Carbon Credits

While buying and selling carbon credits is a great way to offset your emissions or invest in carbon reduction projects, there is more than one way to make money in the carbon credit market.

Here are some specific ways to do so.

Carbon-Credit ETFs

ETFs stand for exchange-traded funds. They are a type of security that can be traded on an exchange, and they often track an index, commodity, or basket of assets.

ETFs are carbon credit stocks that you can buy shares of - just like any other company. The value of the ETF will go up and down based on the price of carbon credits.

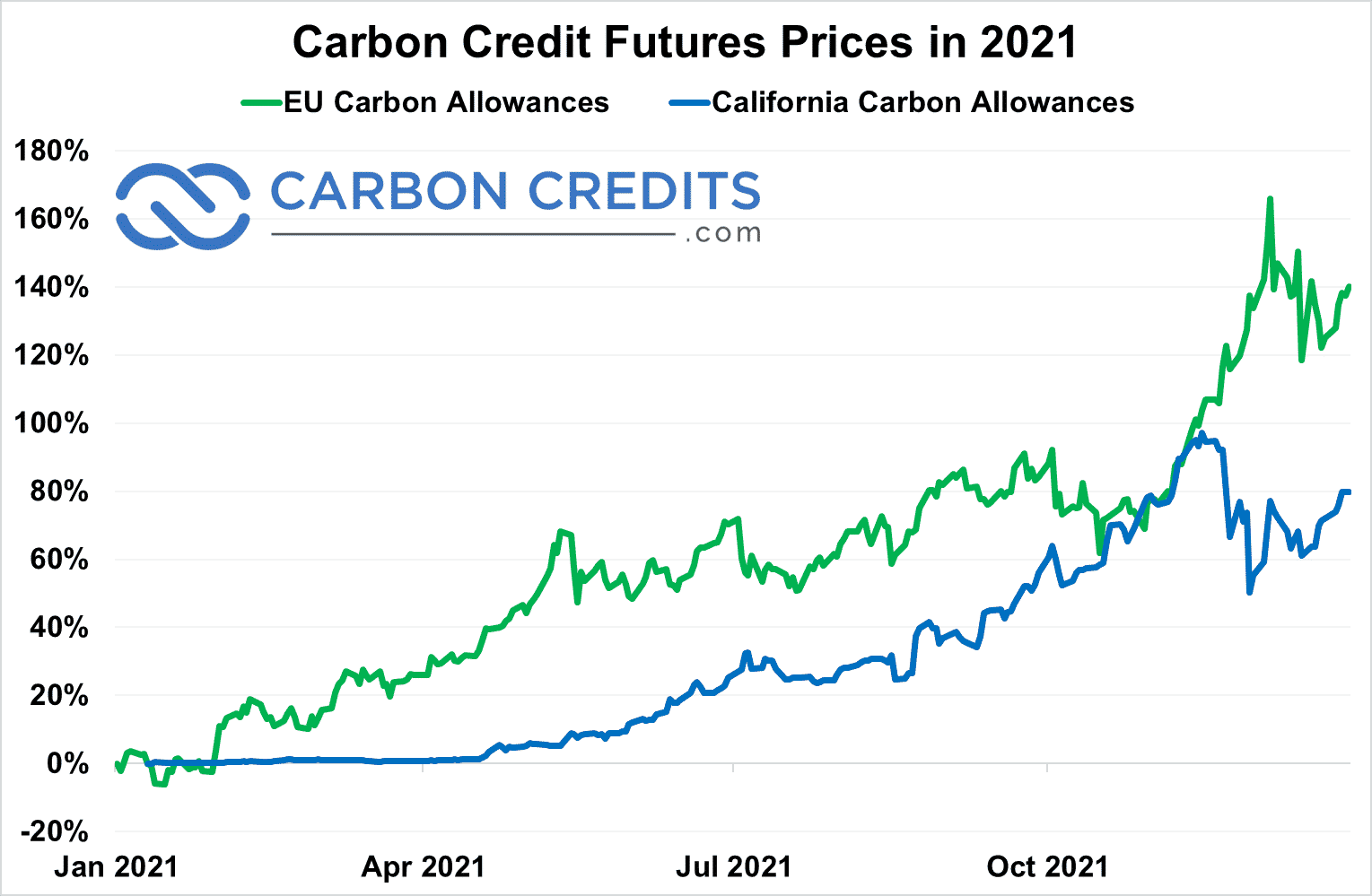

Image credit: https://carboncredits.com/

Carbon-Credit Futures

Carbon-credit futures are a type of derivative, a financial contract whose value is based on an underlying asset.

In the case of carbon-credit futures, the underlying asset is carbon credit. These contracts are traded on exchanges and can be used to speculate on the future price of carbon credits or hedge against price changes.

Individual Companies

Some companies specialize in carbon credits. These companies may own carbon-reduction projects, or they may trade in carbon credits.

Investing in these companies is a way to bet on the future of the carbon market. If the market grows, these companies should do well.

Price Of Carbon Credits: How Much Is A Carbon Credit Worth?

Knowing how much a carbon credit is worth is essential for anyone looking to invest in them. The price of carbon credits can vary depending on several factors, including the location of the project generating the credits, the type of project, and the volume of credits being generated.

According to Climatetrade.com, the average carbon credit worldwide prices on the voluntary market went from $2.49/tCO2e in 2020 to US$3.82/tCO2e in 2021.

The number of credit volumes also went up by more than 90% when comparing 2021 to 2020, which indicates a high demand for carbon credits.

A carbon credit price chart can give you a good idea of how the price of carbon credits has changed over time. That said, with the price of carbon credits rising steadily, now is a good time to invest in carbon credits.

What Is The Current Price Of Carbon Credits?

As of the time of writing this article, the price of a carbon credit is $40-80 for each metric ton of carbon dioxide emitted.

How To Create Carbon Credits

There are various ways by which you can create carbon credits. Let's look at some of the most common ones below.

Returning Biomass To The Soil

The first method is by returning biomass to the soil. This can be done through a process known as composting. Composting is breaking down organic matter, such as leaves and grass clippings, into a nutrient-rich soil amendment.

Not only does this add valuable nutrients back into the soil, but it also helps to improve the soil's water-holding capacity and ability to support plant growth.

Using Conservation Tillage Or No-Tillage Practices

Another way of creating carbon credits is using conservation tillage or no-tillage practices.

Conservation tillage is a type of farming practice that minimizes the amount of soil disturbance. This can be done through crop residue, mulch, or no-tillage systems.

No-tillage farming is a conservation tillage practice that eliminates soil disturbance. This is done by planting crops directly into the previous crop's residue.

Using Nutrient Management And Precision Farming

Nutrient management is the process of applying fertilizers in a way that minimizes environmental impact while maximizing crop production.

Precision farming is a type of agriculture that relies on information technology to maximize yield and minimize inputs. This can be done through GPS mapping, sensors, and yield monitors.

Planting Cover Crops During The Off-Season

Cover crops are plants that are grown to protect and improve the soil. They help to reduce erosion, improve soil fertility, and suppress weeds.

Farmers can plant cover crops during the off-season to improve the soil by adding organic matter and nutrients. This helps to improve the soil's water-holding capacity, aeration, and drainage.

Replacing Surface Irrigation Systems

Surface irrigation is a type of irrigation that uses gravity to apply water to the field. This can be done through floods, sprays, or dribbles.

While this type of irrigation is often less expensive than other methods, it is also less efficient and can lead to water waste. By replacing surface irrigation systems with more efficient methods, such as drip irrigation, farmers can help to reduce water waste and improve crop production.

Promoting Forest Regrowth

Another way to create carbon credits is by promoting forest regrowth. Forests play an essential role in the global carbon cycle by sequestering carbon dioxide from the atmosphere.

Deforestation, however, releases this stored carbon dioxide back into the atmosphere. Reforesting degraded lands helps to restore these lost forests and their ability to store carbon dioxide.

Who Buys Carbon Credits?

There are a variety of entities that buy carbon credits, including:

These entities help drive the demand for carbon credits and create a market for them. By buying carbon credits, they can help to offset their emissions and support projects that help to reduce greenhouse gas emissions.

Pros And Cons Of Investing In Carbon Credits

Using carbon credits to offset emissions has both advantages and disadvantages.

Pros Of Investing In Carbon Credits

There are several advantages to investing in carbon credits.

First, carbon credits can be used to offset emissions from various sources, including power plants, manufacturing facilities, and vehicles. This can help to reduce the carbon footprint of big polluters.

Second, carbon credits can help to support projects that reduce greenhouse gas emissions. This includes projects that promote renewable energy, improve energy efficiency, or protect forests.

Third, carbon credits can be a source of revenue for businesses and organizations. This revenue can be used to fund emissions-reduction efforts or other sustainable development initiatives.

Cons Of Investing In Carbon Credits

There are also several disadvantages to investing in carbon credits.

First, carbon credits alone cannot solve the problem of climate change. They must be used with other mitigation measures, such as energy efficiency and renewable energy.

Second, carbon credits can be difficult to price and value. This is because the price of carbon credits depends on many factors, including the type of credit, the source of emissions, the country where the emissions originate, and the market in which the credits are traded.

Third, carbon credits can be subject to fraud and abuse. This is because it can be challenging to track and verify emissions reductions, making it easy for unscrupulous actors to price carbon credits as they please or sell fraudulent credits.

How Does A Country Get A Carbon Credit?

Countries can earn carbon credits by implementing projects that reduce emissions or sequester carbon dioxide.

Figuring out how to earn carbon credits involves countries that must first establish baselines for their emissions. They then implement projects that help to reduce their emissions below these baselines.

Projects that can help countries earn carbon credits include reducing deforestation, promoting renewable energy, and improving energy efficiency.

Once a country has earned carbon credits, it can sell them to businesses or organizations looking to offset its emissions.

How Are Carbon Credits Calculated?

Carbon credit pricing is typically calculated in U.S. dollars per metric ton of carbon dioxide equivalent (CO2e).

To calculate the carbon credit price, you must first determine the project's metric ton CO2e emission reduction. This can be done by using emission factors, which are values that represent the emissions of a specific activity.

Carbon Credits - FAQ

A carbon credit is a certificate that represents the right to emit one metric ton of carbon dioxide equivalent (CO2e). Knowing how carbon credit works allows you to buy and sell the proper credits to offset emissions.

Several organizations issue carbon credits, but the United Nations Framework Convention on Climate Change (UNFCCC) is the most common. The UNFCCC issues carbon credits to countries and businesses that have reduced greenhouse gas emissions below their 'allocated amount.'

Carbon credit investing is attractive for several reasons:

Apart from the monetary value, one of the best tips for happiness used to push people towards investing in carbon credits allows you to feel good about yourself since it feels great to know that your money is supporting projects that are helpful to the environment.

The price of carbon credits varies depending on several factors, including the type of credit, the location of the project, and the level of emissions reductions. However, carbon credits typically trade between $5 and $30 per tonne of CO2e.

Understanding the cost of buying and the cost of selling will show you how to profit from carbon credits.

In addition to carbon credit stocks, there are carbon credit cards. These are special cards that allow the cardholder to make purchases and receive rewards in the form of carbon credits.

The value of the carbon credits received depends on the type of card and the terms of the agreement between the card issuer and the merchant. However, it is typically a fixed number of carbon credits per dollar, typically based on who sells carbon credits for the merchant.

These cards can be used anywhere that accepts credit cards. The rewards can be used to offset the carbon footprint of the cardholder or donated to a carbon offset project.

Conclusion

So, there you have it! A complete guide to carbon credits and how you can invest in them.

As an investor who wants ideas about earning money online, carbon credits are a great option. They are relatively new, which means there is potential for significant price growth.

As with any tips for wealth you come across, be sure to do your research before making any final decisions. It's a good idea to consult with a financial advisor to get the most professional and unbiased advice.

Want more income ideas? Check out The Lazy Man’s Guide To Living The Good Life, where we discuss various methods for earning money from the comfort of your home.

0 comments