Taxes.

The number one thing people hate about taxes is having to pay them.

The second thing they hate about them is having to do them.

No one wants to sit down and sort through the different receipts and documents, trying to figure out what can be deducted and what can't.

This is where tax software comes in.

Tax software makes it easy to keep track of your deductions and get your taxes done quickly and easily.

There are a lot of different tax software programs out there, so it can be tough to know which is the best for your needs.

To help you out, I've put together a list of the top tax software programs for small businesses.

This will help you choose the right software for your business and make tax time a breeze.

Let's get right into it.

Tax Software For Small Business

I will divide this list into two broad categories - online tax filing systems and free tax software.

The first category, online tax filing systems, are web-based solutions that let you file your taxes online.

These systems are convenient because you can access them from anywhere and are usually very user-friendly.

The downside is that they typically come with a monthly or annual fee.

The second category, free tax software, are programs that you can use without paying anything when getting started.

Some of these programs are very basic, while others are pretty sophisticated.

Online Tax Filing For Small Business

The following are some of the best software to file small business taxes online.

1. TurboTax

Best Overall Tax Software

When you use TurboTax Live as your small business tax preparation service, you'll have access to tax experts who can answer your questions and help you through the entire process. And, if you opt for TurboTax Live Full Service, your dedicated tax expert will even file your taxes for you! They'll ensure everything is done right so you can get the biggest refund possible.

TurboTax is known for finding every deduction and credit available to taxpayers. That's because they have a team of dedicated tax experts who stay up-to-date on the latest changes in tax law. So, when you use TurboTax Live, you can be confident that you're getting the most money back.

Key Features

Pricing

The price depends on various factors, including whether you deal with federal or state tax.

Simply create an account to get started with this service.

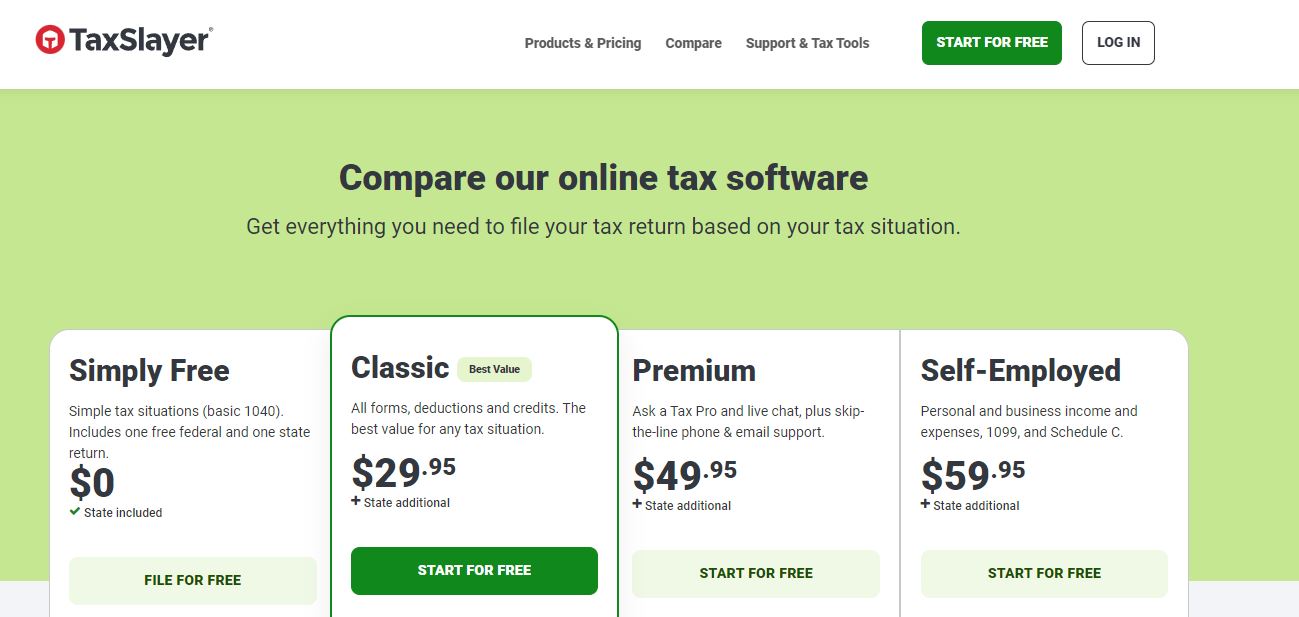

2. TaxSlayer

Best For Customer Support

TaxSlayer is a tax preparation software that gives users the right tools at the right price to get the biggest refund possible. Users can receive their refund via direct deposit and e-file their return for the fastest refund possible.

In addition to being affordable and easy to use, TaxSlayer offers free, unlimited phone and email support and additional help options like Ask a Tax Pro and Audit Defense. And for those who want to go mobile, the TaxSlayer app is available for download on the App Store or Google Play – it provides users with filing resources, news, tips, and more delivered straight to their inboxes.

Key Features

Pricing

TaxSlayer offers these pricing plans:

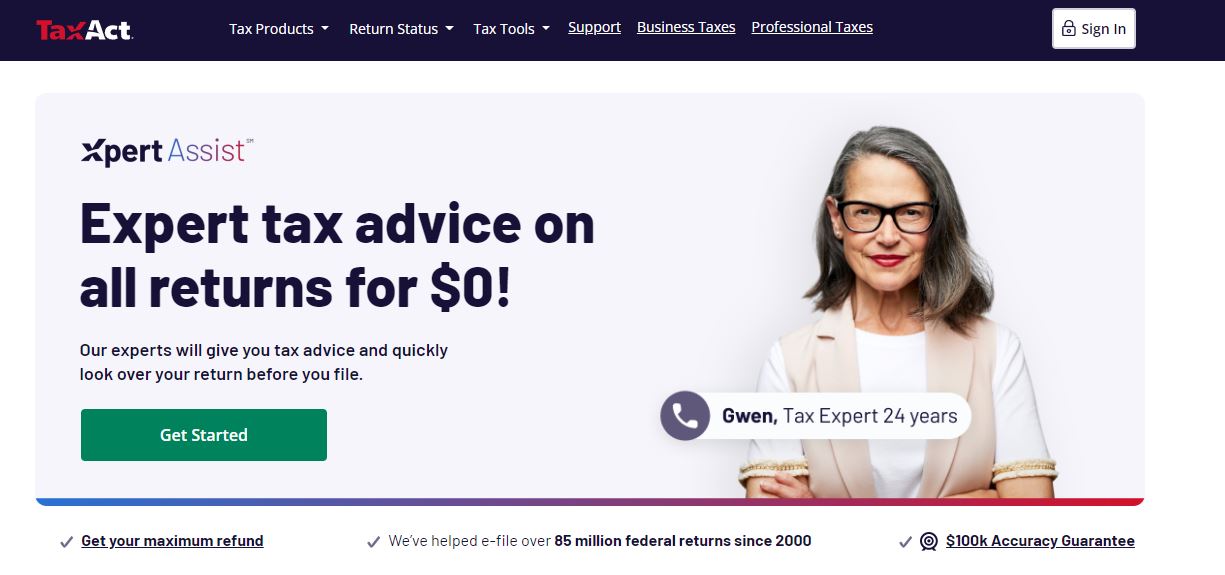

3. TaxAct

Best For Tax Accuracy

TaxAct offers free tax advice from experts for all returns.

They also offer a $100k Accuracy Guarantee while their live tax experts can help you file quickly and confidently. This means that you don't have to go it alone. If you're unsure about something, you can ask for a quick, helpful response.

TaxAct has an excellent track record, having helped e-file over 85 million federal returns since 2000.

Getting started with TaxAct is easy - create an account and follow the instructions on the screen.

Key Features

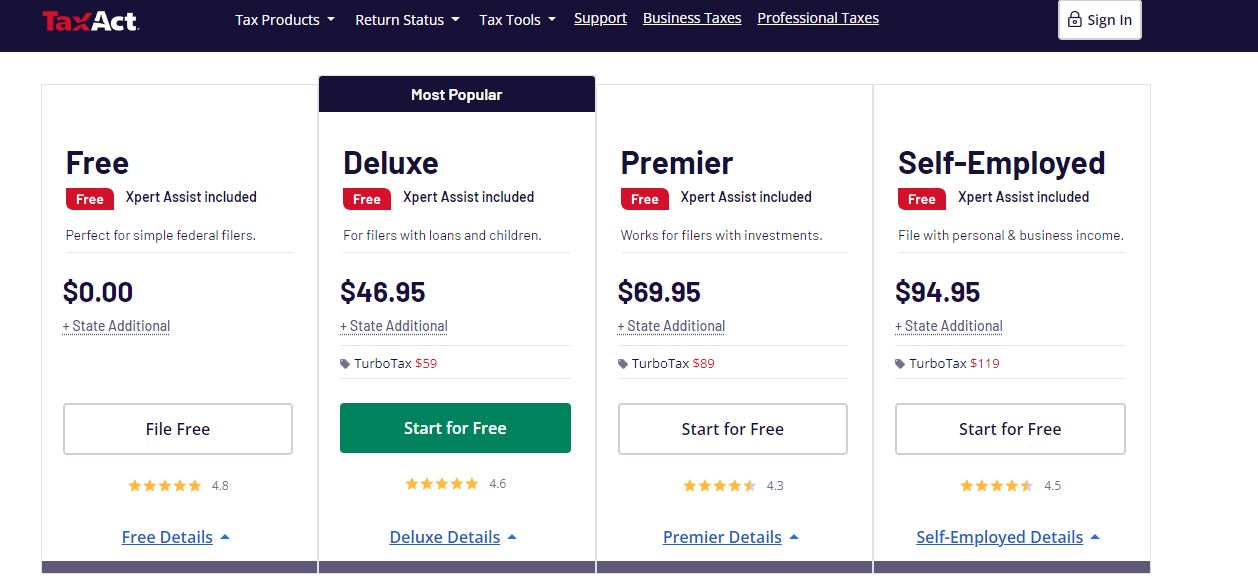

Pricing

TaxSlayer offers these pricing plans:

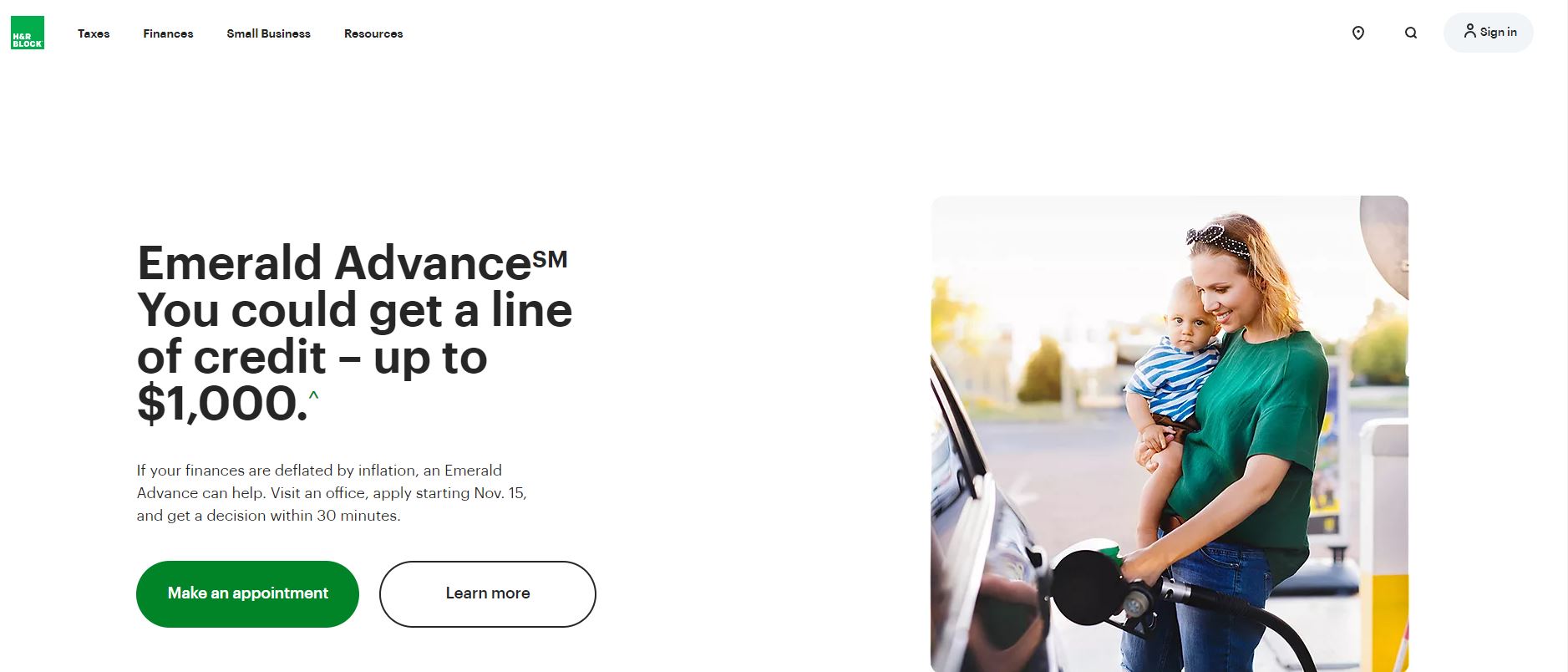

4. H&R Block

Best For Getting A Line Of Credit Asap

One thing that sets H&R Block apart from other tax software options is that they offer a line of credit of up to $1,000. This can be a lifesaver if you expect a refund but need access to funds before receiving your refund.

With other tax software options, you would have to wait until you receive your refund before accessing those funds. This line of credit from H&R Block gives you the peace of mind that you can access your refund as soon as it is processed – without having to wait.

Another great benefit of using H&R Block tax software is that they include several federal e-files with your purchase. That means you can file your federal taxes for free – without worrying about hidden fees or extras you didn't account for. And, if you need help along the way, H&R Block has a team of experts available via chat, email, or phone so that you can get the answers you need when you need them.

Key Features

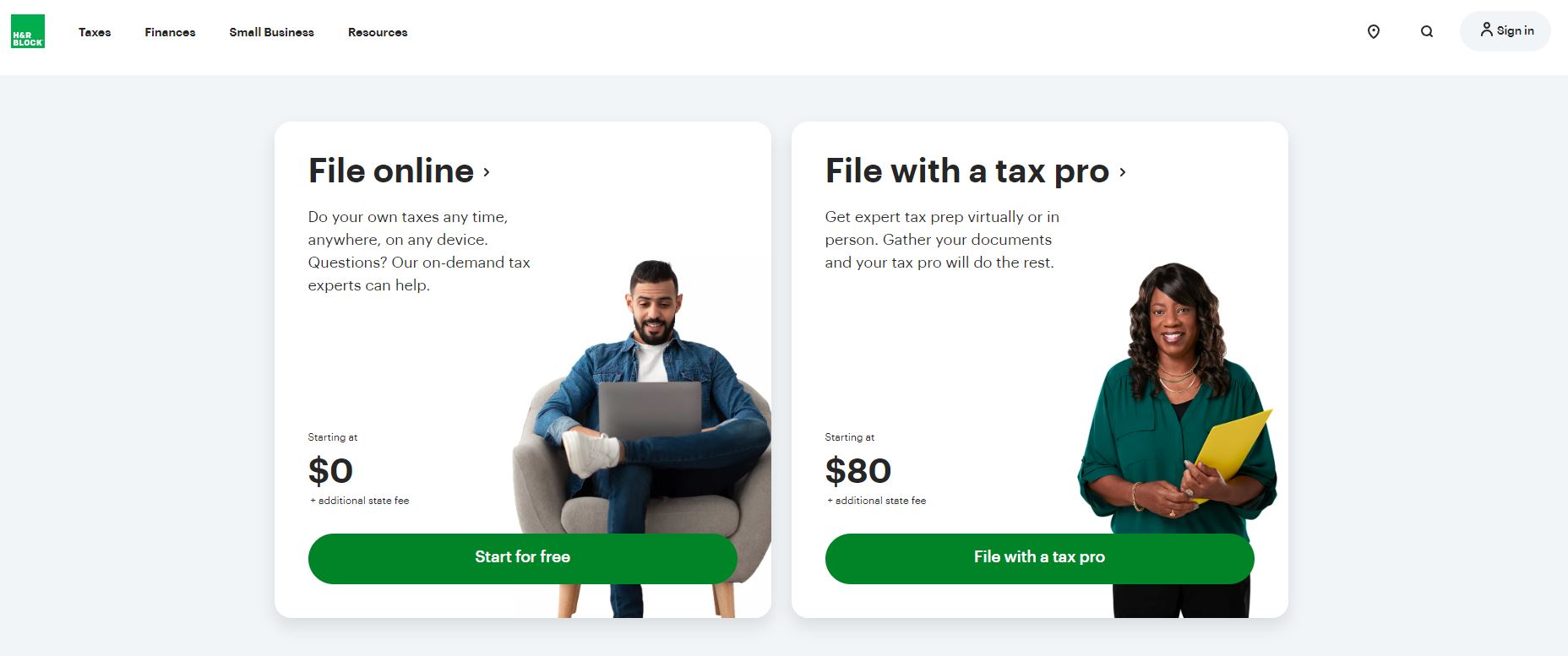

Pricing

H&R Block offers these pricing plans starting from $80.

The final cost will be based on various factors, including your state, add-ons, and more.

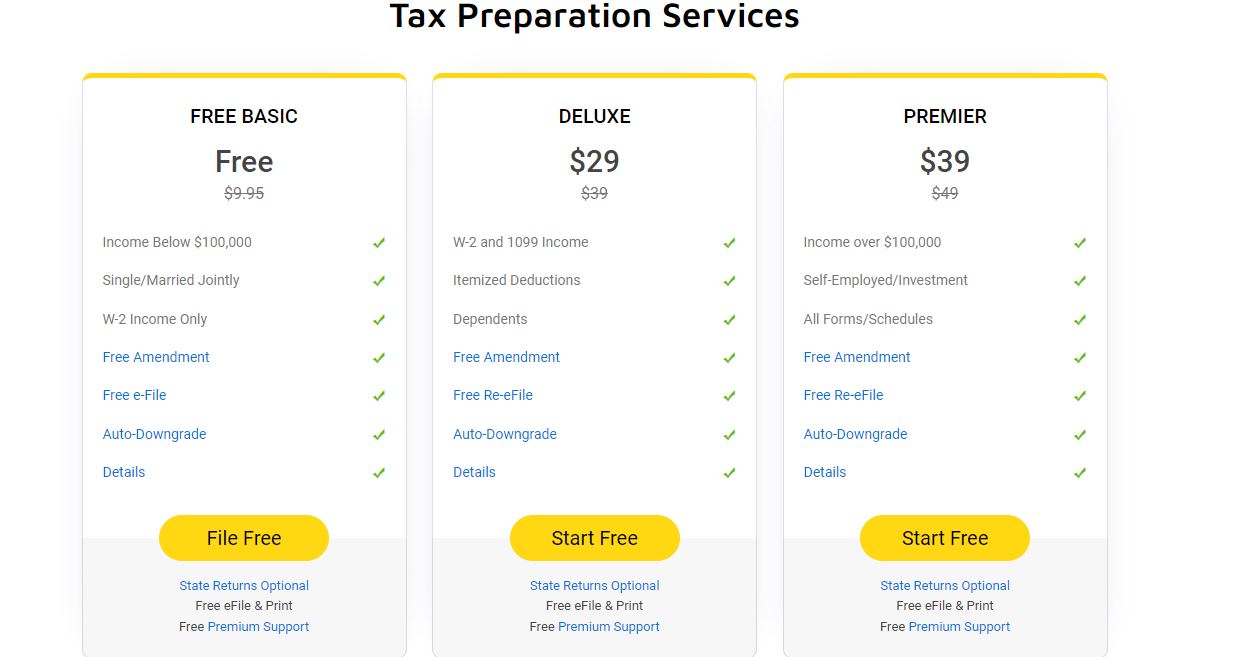

5. eFile.com

Best For Free Amendments

eFile.com is a website that makes preparing and filing your taxes easy and stress-free. With a team of experts available to answer any questions, you can feel confident about doing your taxes. eFile.com is also popular because it makes filing easy and painless with its calculators and tools.

eFile also offers free amendments and refiling, so no matter how many times you need to file, it won't cost you anything extra.

Key Features

Pricing

eFile offers these plans:

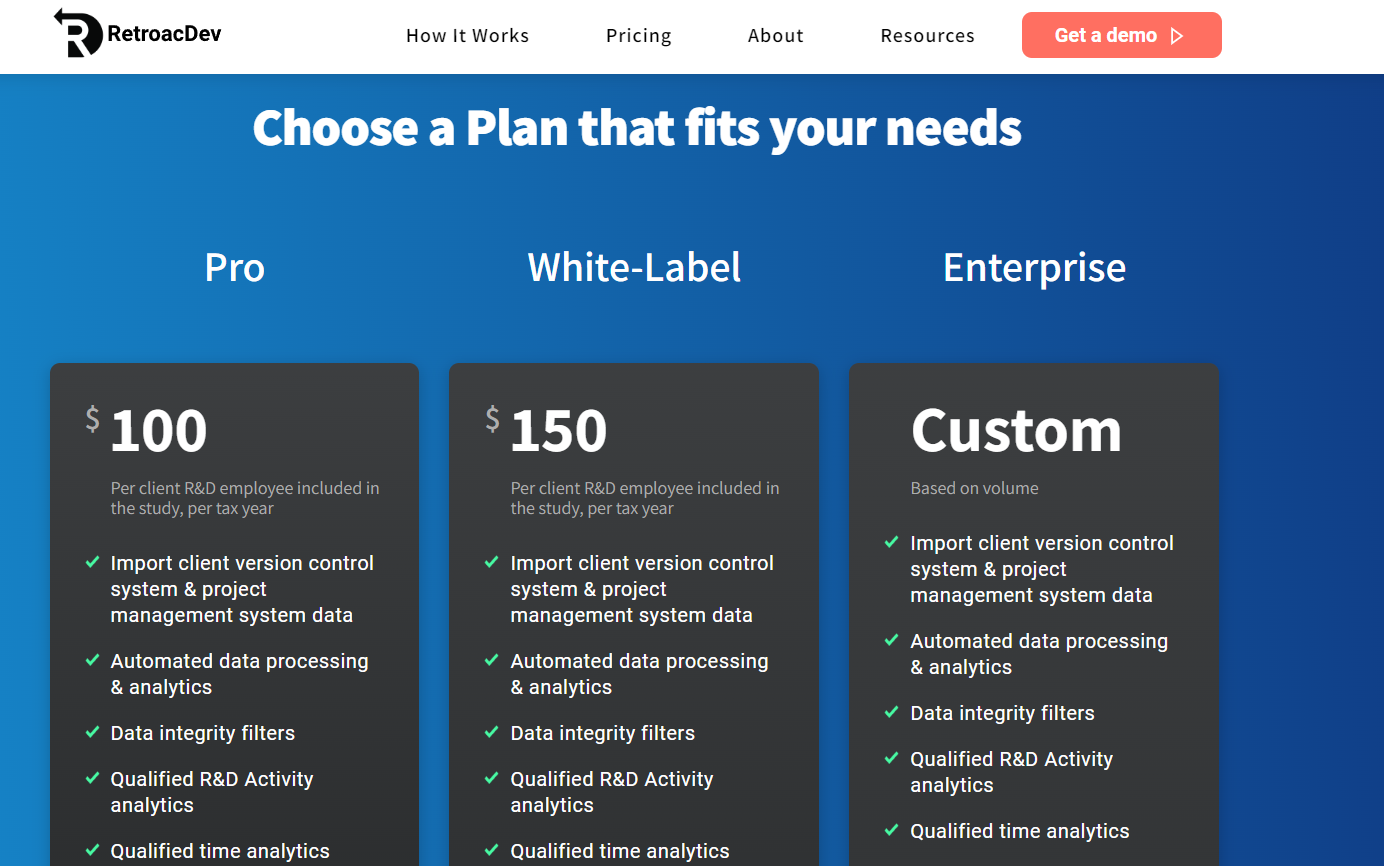

6. RetroacDev

Best For Calculating Qualified Research Expenses

The RetroacDev Tax Credit Platform is best for small businesses and startups looking for tax breaks and incentives.

Between calculating Qualified Research Expenses (QREs) and substantiating the tax credit, it's easy to see how things can get complicated quickly. That's where the RetroacDev Tax Credit Platform comes in. This innovative software takes the guesswork out of claiming R&D tax credits by automatically classifying employee activities and calculating QREs. In other words, it does all the heavy lifting for you so you can focus on what you do best: growing your business.

The RetroacDev Tax Credit Platform makes claiming R&D tax credits easier and helps ensure you get the maximum tax credit you are entitled to. The software can create contemporaneous documentation of Qualified Research Activities (QRAs) by running data through A.I. and rule-based classifiers.

This saves you time and gives you peace of mind knowing you are getting the most out of your taxes.

Key Features

Pricing

RetroacDev offers these pricing plans:

Cheap Or Free Small Business Tax Software

Now, look at some of the best cheap or free small business tax software options available.

7. UFileT2

Best For Step By Step Tax Processing

UFile T2 is a great corporate tax software that one can use to file corporation tax returns. The software has a step-by-step interview process specifically for incorporated businesses, which makes it very user-friendly.

Additionally, UFile T1 (ONLINE) now offers free telephone support, an excellent perk for small businesses that might need extra help during tax season.

Key Features

Pricing

UFileT2 allows you to start free and only pay for certain features as needed.

8. Taxjoy

Best Tax-Task Management

With Taxjoy, everything is organized by the client, so you can always find what you're looking for. Plus, their document-sharing feature makes it easy to share essential documents with clients or team members. And because deadlines are important in the tax preparation process, they've also included a task management feature, so nobody misses a deadline.

Taxjoy is designed to streamline communication between tax professionals and their clients. When you sign up for Taxjoy, you'll be able to create a profile for yourself and your business. Then, you can start adding clients to your account. Once a client is added, all of your communications with that client will be automatically organized in one place. This includes messages, documents, and tasks.

Messages are sent and received through Taxjoy's secure messaging system. You can easily find past messages by searching for keywords or filtering by date. Plus, all messages are automatically stored safely so that you can access them later.

Key Features

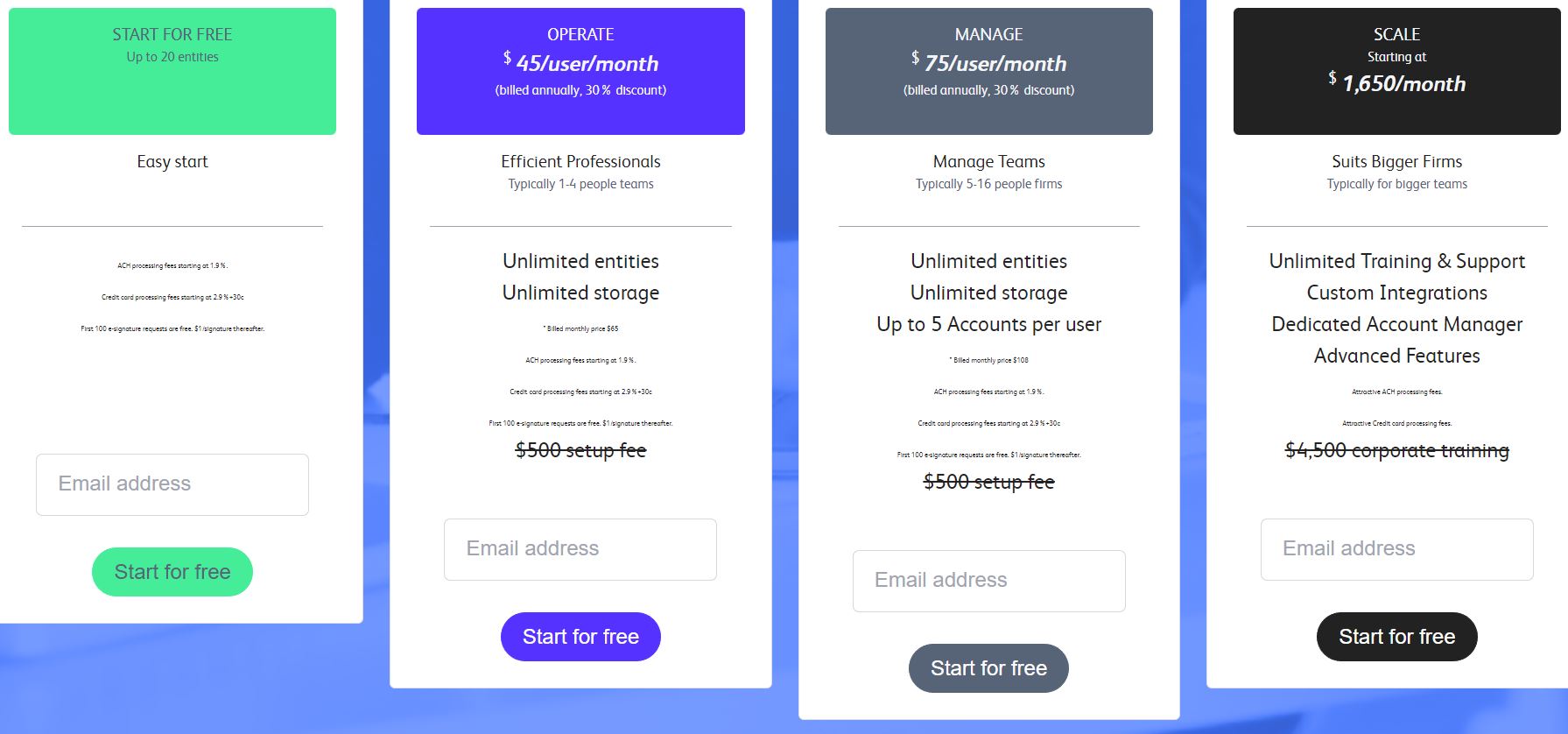

Pricing

Taxjoy allows you to use their software for free, allowing up to 20 entities without paying.

9. TaxCloud

Best For Continuous Tax Software Development

TaxCloud is an affordable sales tax compliance service that offers industry-leading tax data, automated filing options, and some of the lowest prices in the USA.

They determine the applicable sales tax rate based on product and service taxability, collect sales tax at the time of the transaction on your site when customers checkout and file returns, and remit collected sales tax proceeds to the appropriate state and local jurisdictions.

With comprehensive U.S. sales tax data, exemption management tools, a filing system, and audit protection services, they have everything you need to keep your business compliant - all without breaking the bank.

Key Features

Pricing

With some of the lowest prices industry-wide, TaxCloud offers various plans for different needs.

10. FreeTaxUSA

Best For Getting Rapid Support

FreeTaxUSA is an excellent option for small businesses and individuals looking to get the most out of their tax returns. For only $6.99, their Deluxe plan will send you to the front of the line if you have questions, assist you if you're audited, and give you unlimited amended returns.

That's peace of mind that's worth every penny! And if that's not enough, you can also get more peace of mind by importing your prior year's return from any other platform.

FreeTaxUSA can assist you if you're audited and offer unlimited amended returns.

Key Features

Pricing

FreeTaxUSA offers free returns. There is also a Deluxe package that costs $7.99 that offers various features that make your tax preparation easier.

Benefits That Tax Software Brings To Small Businesses

Using the right tax software can provide tons of benefits to small businesses.

Here are some of the top ones to consider.

Saves Time

Both paid and free software for small business taxes can save you time.

This is because the software will handle all the calculations for you, and some even fill in the necessary forms. This can be a huge time saver, especially if you have a complex return.

Some of the best software for filing small business taxes can also help you file your return electronically. This can save you time, as you won't have to print and mail your return.

Saves Money

Small business accounting software taxes not only saves time but it can also save money.

This happens because you cannot only get more deductions with the help of tax software but also avoid costly mistakes.

Promotes Accuracy

Some of the top software in this industry comes with error-checking features that will catch any mistakes you might make.

This can save you time and hassle in the long run.

Accurate and error-free tax returns can provide peace of mind during tax season, primarily if you don't get audited by the IRS.

Also, if you use software that offers audit assistance, you can get extra help for even more accuracy - especially if you are selected for an audit.

This can give you the confidence you need to deal with the IRS.

Simplifies The Tax Filing Process

The process of earning money online has gotten a lot simpler in recent years.

However, the process of filing taxes has remained relatively unchanged. This can be confusing and complicated for many small business owners.

Fortunately, tax software can simplify the tax filing process. With templates that are easy to follow and software that does the calculations for you, tax software can make filing taxes much easier.

Keeps Business Records Organized

To file your taxes, you must keep track of your business income and expenses. This can be a lot of work, especially if you don't have a sound system.

Fortunately, tax software can help you keep your business records organized, tracking your income and expenses.

Facilitates Year-Round Tax Planning

If you want to minimize your taxes, it's essential to plan. This is where tax software can be beneficial.

With tax software, you can input your projected income and expenses for the year. This will allow you to see how different tax scenarios will affect your bottom line. This information can help you make better decisions about your business throughout the year.

Makes It Easier To File Multiple State Returns

Finally, if you have a small business that operates in multiple states, you know how difficult it can be to file your taxes. This is because you have to deal with different tax laws in each state.

However, using tax software, you can easily file your taxes in multiple states using tools designed to handle complex tax situations.

Features Of The Top Tax Software Programs

In this final section, let's look at some of the features you should look for in tax software.

Support For Multiple Tax Situations

Part of learning how to make money without a job should include knowing how to file taxes.

This is because it's essential to know how to file your taxes properly to avoid penalties or interest charges.

For example, if you are a sole proprietor, you must file a Schedule C with your personal tax return. This form is used to report your business income and expenses. If you are a partnership, you will need to file Form 1065. This form is used to report the income and expenses of the partnership. If you are a corporation, you will need to file Form 1120. This form is used to report the income and expenses of the corporation.

As you can see, different forms need to be filed depending on your business structure.

While tax software can't completely take over the whole process, choosing the right software that offers support for multiple tax situations is essential.

Ability To File Federal And State Taxes

The correct tax preparer software for small businesses should also allow you to file federal and state taxes. This is because most small businesses will have to file both federal and state taxes.

You can use the IRS Free File program if you only need to file federal taxes. However, if you need to file federal and state taxes, using a paid tax software program is a good idea.Automatic Updates For Tax Law Changes

Small business tax programs should reflect any changes in the tax law. Choosing a tax software program that offers automatic updates is essential.

This way, you can be sure that you are using the most up-to-date version of the software. This can save you a lot of time and hassle come tax season.

Integration With Other Software

A business combines multiple parts to function as a whole. This is also the case with tax software. The best tax software for small businesses should integrate with other software that you are using.

For example, email marketing software for small businesses is often used to send out invoices and important notifications to stakeholders. As such, it would be helpful if your tax software could integrate with this.Live Chat And Email Support

Finally, the best software for filing taxes for small businesses should offer live chat and email support. This way, you can get help from a tax expert if you have any questions or need assistance with the software.

Tax Software For Small Business - FAQ

Yes, there are multiple software programs that can help you calculate your small business taxes. Choosing the right software will depend on your specific business needs.

Tax record keeping tools for small businesses are key to success because they help you keep track of your income and expenses. This information is essential come tax time.

Conclusion

There's a lot to take in when it comes to finding the best tax service for small business.

Choosing the best software for small business taxes means considering your business's specific needs.

This also includes understanding the different features available in tax software and how they can benefit your business.

If you want information on how to make money while living the life you want, check out The Lazy Man's Guide To Living The Good Life. You'll get many ideas regarding business, travel, lifestyle design, and more.

0 comments